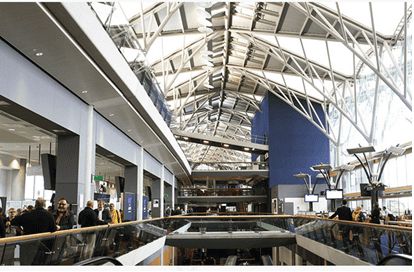

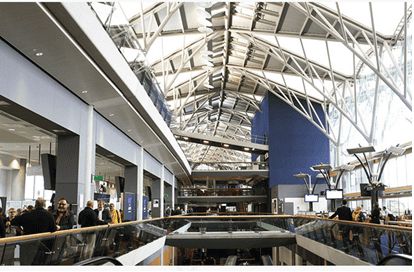

UK Hi-fi Show 2023

Ascot, September 2023 Press Day was quiet on the Friday 29th of this three day Hi Fi show, which suited us just fine, enjoying great

Ascot, September 2023 Press Day was quiet on the Friday 29th of this three day Hi Fi show, which suited us just fine, enjoying great

New 600 series from B&W, here the stand mount 607 in a classic room setting….classic because the system is pure analogue vinyl, LP based, no

A staunch supporter of HIFICRITIC, Peter Maguire’s long journey encompassing the finessing of his audio system has taken decades.

Held in the larger demonstration room at London’s KJ audio store at New Cavendish Street, W1 and hosted by Ricardo Franasovicci of Absolute Sounds, Alon

Arguably the LINN LP12 is the world’s most famous high quality record playing turntable and now celebrates its half century. There were fears, even predictions

From the mid-1980s to early 1990s the Musicassette, a miniaturised analog magnetic tape medium, was the dominant recorded music format with UK sales of over 0.25

Against all expectations Vinyl or LP disc sales have boomed in recent years, and have recently exceeded CD by value, but we also know that

Clarity is an audio industry body which encourages and supports higher standards in audio retail, to better inform, support and serve customers. Held at the

Listening to music on headphones or earbuds at ’ 50% volume’ for an hour a day can be detrimental to a young person’s hearing ……

by Martin Colloms, First Published HiFi News, June 1978 The last year or so has seen the emergence of a new generation of high-quality open-reel

Dick Weindling and Marianne Colloms for HIFICRITIC It was sad to hear that Chris Barber, the jazz trombonist and band leader, died aged 90, on

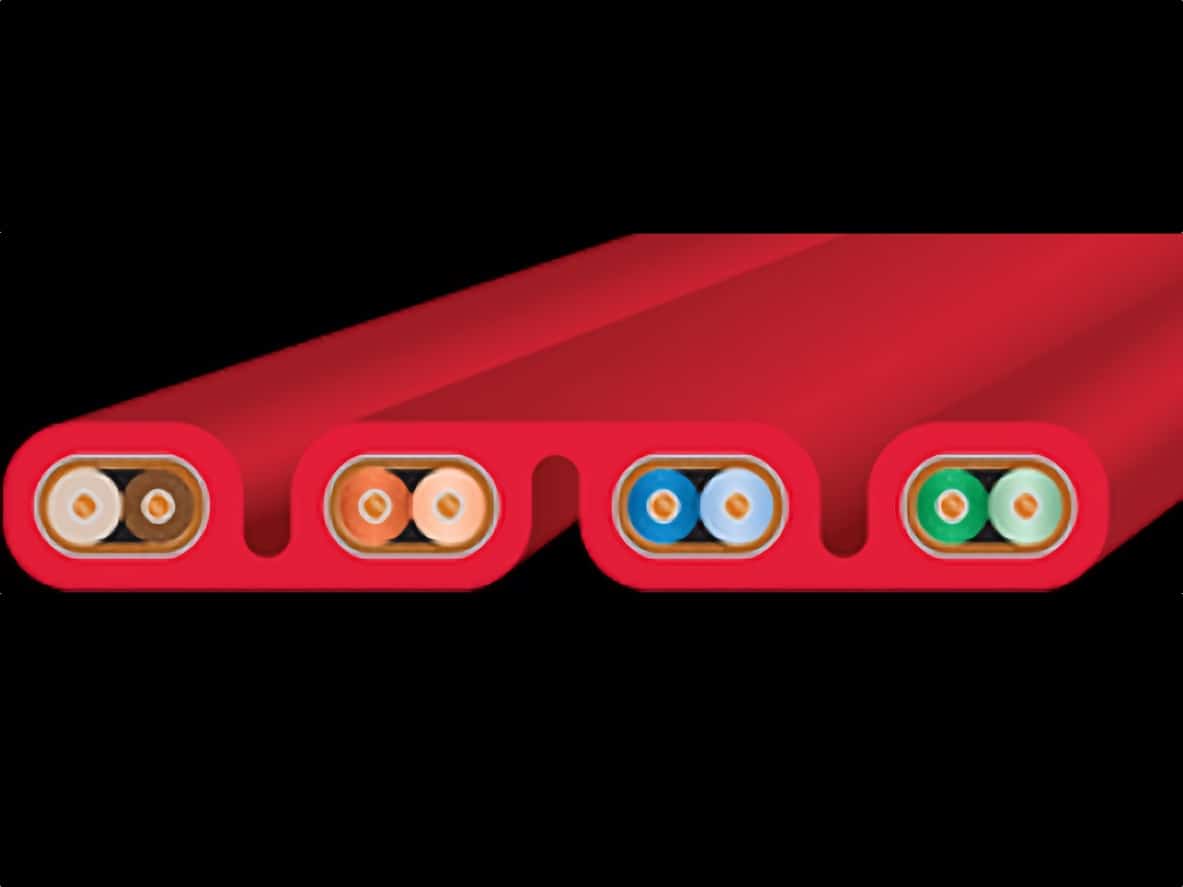

Preview: HIFICRITIC Vol 14 No2 April-June 2020 issue I have almost lost count of the 100 or so listening tests recently conducted on network cables

Historical Review: Martin Colloms April 1993 Tannoy has made steady progress on the studio monitor market over decades. Medium sized monitors are required to have

The Library of Congress has released from the national recording registry the ultimate stay at home playlist. The following announcement was just released from Washington

The new Bang & Olufsen flagship speaker, the BeoLab 90, was unveiled by the company at an event held close to its headquarters in Struer,

© Copyright 2024 Martin Colloms | Terms of Use | Privacy Policy | Cookies | Contact